Donald Trump has threatened to impose huge secondary sanctions on all buyers of Russian oil if Vladimir Putin continues to delay a ceasefire agreement in Ukraine, a move that would significantly impact major importers India and China.

Mr Trump said he was “very angry” and “pissed off” at Putin’s suggestion that the government in Kyiv would have to change before any peace deal can be signed.

He said there would be “a 25 to 50-point tariff on all oil” if a deal is not made between Russia and Ukraine and “if I think it was Russia’s fault”.

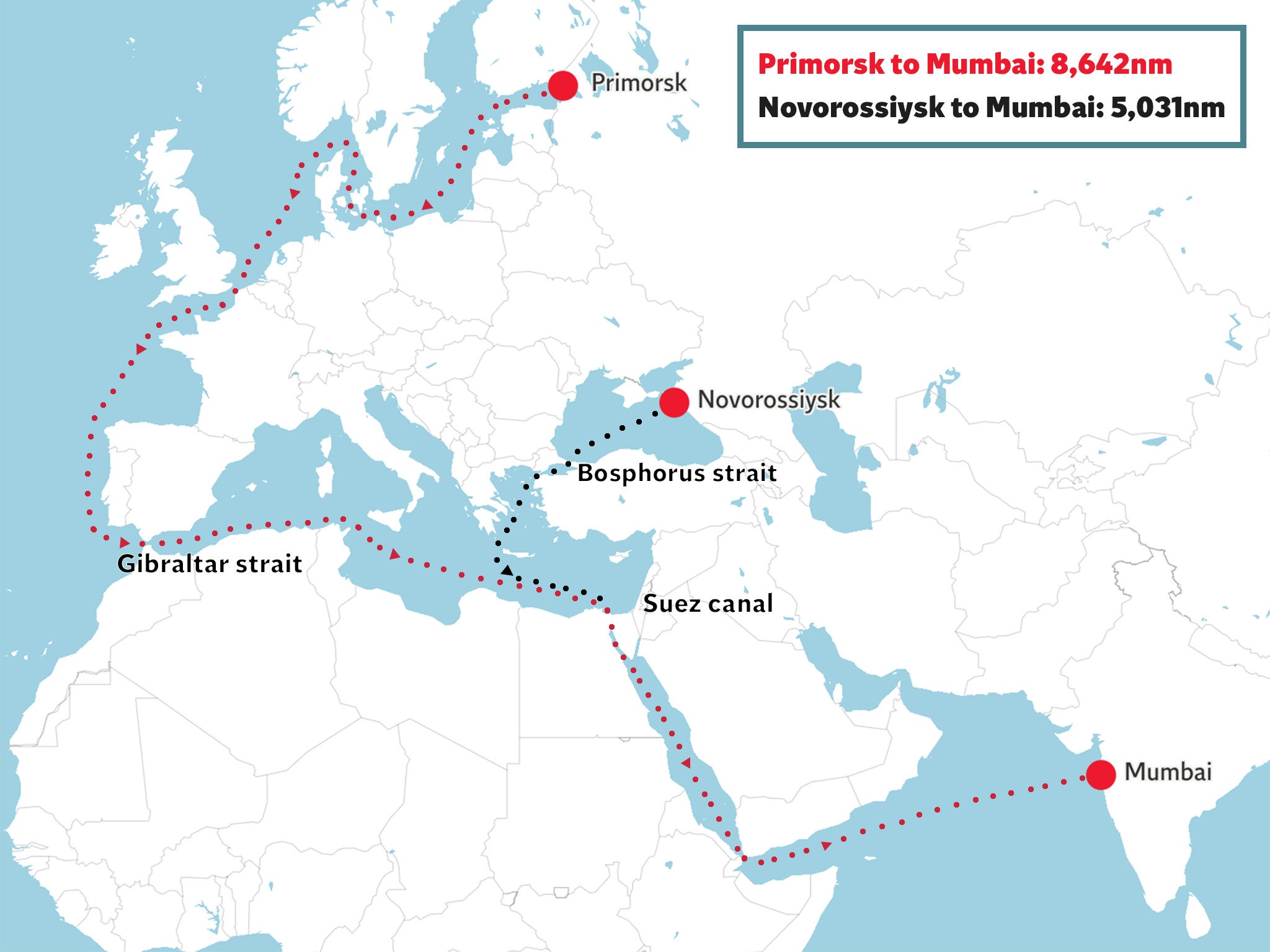

China and India are the countries most likely to be affected if the US president follows through with the threat, having emerged as the biggest buyers of discounted Russian oil since the start of the Ukraine war.

Until now, limited sanctions on Russian oil have reduced the amount of money flowing into Putin’s war chest without putting a stop to the trade altogether, a move that would have a devastating impact on the global market.

Mr Trump’s sharp comments on Sunday represented a notable shift in his tone towards Russia since starting his second term.

“If Russia and I are unable to make a deal on stopping the bloodshed in Ukraine, and if I think it was Russia’s fault … I am going to put secondary tariffs on oil, on all oil coming out of Russia,” Mr Trump said.

“That would be, that if you buy oil from Russia, you can’t do business in the United States. There will be a 25 per cent tariff on all oil, a 25- to 50-point tariff on all oil.

“Anybody buying oil from Russia will not be able to sell their product, any product, not just oil, into the United States.”

Secondary tariffs function similarly to secondary sanctions, which are financial penalties imposed on countries or individuals for engaging in business with a sanctioned entity.

William Reinsch, a former senior Commerce Department official now at the Center for Strategic and International Studies, said the haphazard way Mr Trump was announcing and threatening tariffs leaves many questions unanswered, including how US officials could trace and prove which countries were buying Russian oil.

Rory Johnston, a Toronto-based oil market researcher, said the secondary oil tariff would be an “immensely bullish shift from the White House”, adding that it would mostly impact India.

“India alone imports [around] 1.7 MMbpd (million barrels per day) of Russian crude and has proven extremely sensitive to secondary sanctions on Iranian and Venezuelan oil,” he added.

India has benefited from the Western world shunning Russian crude and setting a cap on prices for other countries, with the Modi government snapping up discounted barrels and justifying it by saying it is keeping fuel costs down for Indian consumers. At the same time, India has deepened ties with the US in recent years, and Narendra Modi has tried to appease Mr Trump by promising to lower tariffs and working on deals to avoid reciprocal tariffs.

From importing a mere 1 per cent of its total oil requirements from Russia in 2021, India – the world’s third-largest oil importer – guzzled nearly 60 MMbpd of Russian oil in 2022, compared to just 12 MMbpd in all of 2021, according to Kpler.

Imports continued to grow, averaging around 1.78 MMbpd or 40 per cent of India’s total crude imports in 2023. And in 2024, imports peaked at a record 2.07 MMbpd in July, making up 44 per cent of India’s total oil imports.

India surpassed China’s imports in July as Beijing bought 1.76 MMbpd via pipelines and shipments. China was already a significant buyer of Russian oil, importing an average of 1.6 MMbpd in 2021, split evenly between pipeline and seaborne routes, even before the war started.

Clyde Russell, an Asia commodities and energy columnist at Reuters, argued that Mr Trump’s tariff threat might just achieve limited success in its Ukraine aims. “If Putin believes Trump will go ahead and massively boost what are effectively sanctions on Russia’s main export, he may be inclined to back down at least far enough to allow Trump to appear to have ‘won’ in negotiations,” he said.

But he adds that India and China’s responses must also be taken into account in judging whether the gambit has paid off.

Mr Trump appears to be following the template of his threatened secondary sanctions against Venezuela. In a 24 March order, the president said any country importing oil from Venezuela, directly or indirectly, could face an extra 25 per cent tariff on their exports to the US. It means the US could penalise countries like China or Spain by imposing higher tariffs on their exports to the US.

The order gave secretary of state Marco Rubio the authority to impose the tariff at his discretion.